Moderna’s messenger RNA vaccine for respiratory syncytial virus (RSV) is now FDA approved, a regulatory decision that comes nearly a year after GSK and Pfizer won regulatory approvals for their vaccines to prevent infection from the seasonal respiratory virus.

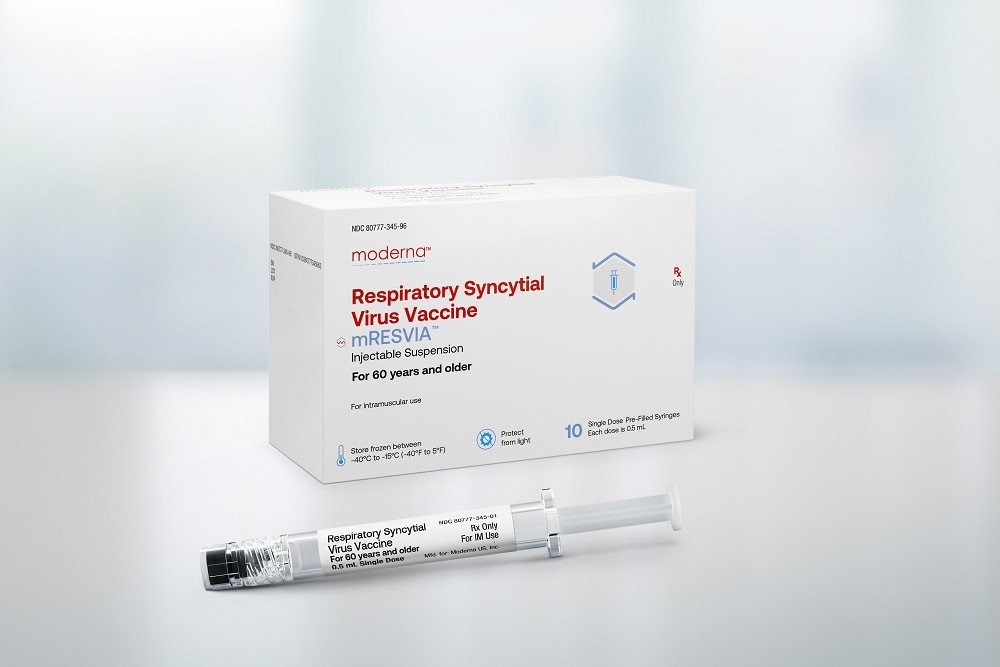

The FDA decision announced Friday covers adults age 60 and older. Known in development as mRNA-1345, Cambridge, Massachusetts-based Moderna will market the vaccine under the brand name mResvia. The company expects the new vaccine will become available before the start of the 2024/2025 respiratory virus season this fall. In the near term, the next step for the vaccine is to secure a recommendation from the Centers for Disease Control and Prevention’s Advisory Committee on Vaccination Practices (ACIP). The Moderna vaccine is on the agenda for the committee’s next meeting, scheduled for late June.

RSV can lead to symptoms resembling those of the common cold, but in the young and the elderly, who have weaker immune systems, the virus can spark potentially deadly respiratory infections. RSV has eluded vaccine developers for decades. In recent years, research has turned to focus on prefusion F, a protein on the surface of the virus that it uses to enter a host’s cells. GSK’s Arexvy and Abrysvo from Pfizer contain antigens that prompt the immune system to produce antibodies against that key protein. By contrast, mResvia consists of a messenger RNA sequence that encodes a stabilized version of prefusion F, which in turn prompts an immune response against the protein. The Moderna RSV vaccine comes from the same technology platform that yielded the company’s mRNA Covid-19 vaccines, Spikevax.

Using Informed Awareness to Transform Care Coordination and Improve the Clinical and Patient Experience

This eBook, in collaboration with Care Logistics, details how hospitals and health systems can facilitate more effective decision-making by operationalizing elevated awareness.

FDA approval of mResvia is based on results from a Phase 3 study that enrolled about 37,000 older adults in 22 countries. At the primary analysis, with 3.7 months of median follow-up, results showed 83.7% efficacy against RSV lower respiratory tract disease. As part of the FDA review, a follow-up analysis was conducted, which included cases that started before the primary analysis cut-off date but were not confirmed until afterward. In this follow-up analysis, efficacy dipped slightly to 78.7%. An additional longer-term analysis showed vaccine efficacy was 62.5% with a median follow-up time of 8.6 months.

Cross-trial comparisons are tricky, but the mResvia efficacy results are below the mark set by GSK’s Arexvy, which showed 82.6% vaccine efficacy with a median follow-up of 6.7 months. Pfizer’s Abrsyvo showed 66.7% vaccine efficacy with a median follow-up of 7 months. In note sent to investors on Friday, William Blair analyst Myles Minter said that while Arexvy’s efficacy is numerically superior, the result could be due to differences in the time to follow-up, the number of events occurring in the trial, and the definition of symptoms in each trial.

Moderna’s vaccine might have a safety edge over the GSK and Pfizer RSV vaccines. Results for the mRNA vaccine’s study showed no serious safety concerns. The most commonly reported adverse reactions included injection site pain, fatigue, headache, and muscle and joint pain. By contrast, the Arexvy trial results showed some cases of a rare type of brain and spinal cord inflammation in participants who received the GSK vaccine at the same time as a flu shot. A case of Guillain-Barre syndrome, a condition in which the immune system damages nerve cells, was also reported. FDA approval of the GSK vaccine required the pharmaceutical giant to conduct additional testing to further assess these risks. Guillain-Barre was also reported in one participant in the Pfizer vaccine’s study, but the FDA did not call for any additional post-marketing testing for that product.

Despite the safety risk, GSK’s Arexvy is the market leader in RSV vaccines, achieving £1.2 billion (about $1.5 billion) in sales in 2023. Pfizer’s Abrysvo tallied about $850 million in sales last year. Moderna needs mResvia to be successful to offset declining revenue for Spikevax as all Covid-19 vaccine makers weather declining demand. The new RSV vaccine is now Moderna’s second FDA-approved product.

The Impact Brands: Empowering Wellness Through Natural and Holistic Solutions

In an era of escalating healthcare costs and a growing preference for natural, holistic approaches to health, The Impact Brands emerges as a collective of diverse brands dedicated to supporting overall wellness through natural means.

The main way Moderna aims to stand apart from the GSK and Pfizer RSV vaccines is through ease of administration. While Arexvy and Abrysvo come in vials that require additional preparatory steps before injection, mResvia comes as a prefilled syringe. Moderna says providing its vaccine this way saves time for the clinician and reduces the risk of errors. Leerink Partners analyst Mani Foroohar expressed skepticism, writing in a research note that the importance of this benefit remains to be seen in light of mResvia’s weakening clinical data from the follow-up analysis and the fact that this vaccine will be launching against two large, entrenched competitors. But William Blair’s Minter is more optimistic.

“While mResvia may not have a best-in-class efficacy profile, we still see a significant market opportunity with the ability to differentiate on convenience of administration and no known [Guillain-Barre syndrome] risk,” Minter said. “The focus now shifts to the expected ACIP recommendation and potential for commercial contracting, which will be critical to Moderna’s return to top-line revenue growth in 2025 and breakeven in 2026.”

Photo by Moderna