Turnstone Biologics aims to bring cell therapy to solid tumors, but competition is tight and its cash is running low. An $80 million IPO now gives Turnstone enough money to continue clinical trials that could show whether it can stand apart from the pack.

La Jolla, California-based Turnstone on Friday priced its offering of nearly 6.7 million shares at $12 each, which was the low end of the $12 to $14 per share range in the preliminary financial terms it set earlier this week. Shares will trade on the Nasdaq under the stock symbol “TSBX.”

Unlocking Transparency in PBM Pricing

The TSX Venture Exchange has a strong history of helping early-stage health and life sciences companies raise patient capital for research and development.

Turnstone could further boost its cash haul. Last month, Takeda Pharmaceutical sent the company a non-binding letter expressing interest in purchasing about $8 million worth of shares in conjunction with the IPO, according to the IPO filing. Takeda already has a stake in Turnstone, having participated in the biotech’s Series D financing round in 2021.

Takeda and AbbVie were partners to Turnstone in an earlier iteration of the company, which formed in 2014 with a focus on oncolytic virus-based immunotherapies. The partnerships provided the young company with $190 million in financing, according to the filing. But in 2020, Turnstone switched gears to cell therapy with the acquisition of Myst Therapeutics. The Takeda and AbbVie partnerships were subsequently terminated.

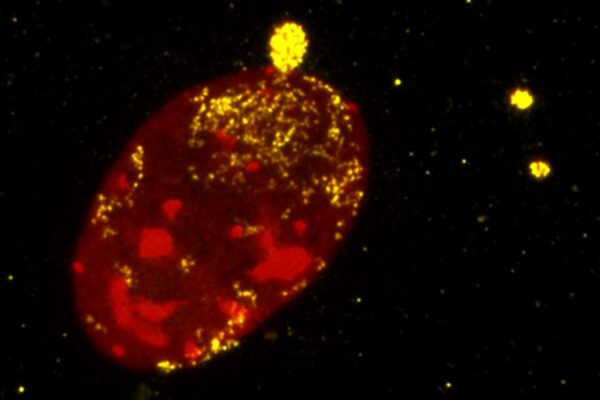

Myst brought Turnstone its research in tumor-infiltrating lymphocytes, or TILs. These cell therapies are made by harvesting TILs from a patient’s tumor and expanding them in a lab. Those cells are then infused into the patient to fight the tumor. Because the cells initially came from a patient’s tumor, they can recognize and penetrate these cancer cells. Those capabilities could make TILs effective against solid tumors, which have been a tougher target for cell therapies overall.

There are no FDA-approved TIL cell therapies yet. Companies pursuing TIL therapies include Instil Bio, Iovance Biotherapeutics, Adaptimmune Therapeutics, Achilles Therapeutics, and Lyell Immunopharma. Turnstone says in the filing that much of the early TIL research involves harvesting TILs in bulk, resulting in insufficient numbers of the most potent immune cells able to spark an anti-tumor response. Turnstone’s approach involves selecting for such tumor-reactive T cells, which it calls “Selected TILs.”

Using Informed Awareness to Transform Care Coordination and Improve the Clinical and Patient Experience

This eBook, in collaboration with Care Logistics, details how hospitals and health systems can facilitate more effective decision-making by operationalizing elevated awareness.

“We believe our Selected TIL approach sets us apart from others in the industry that are utilizing bulk TILs, including newer bulk TIL approaches that introduce gene edits and culture media additives to enhance TIL quality and function,” Turnstone said in the filing. “We believe that without the optimal starting population of tumor-reactive T cells, further enhancements or modifications to bulk TILs are unlikely to succeed in extending their potential utility beyond the limited tumor types where bulk TILs have already shown objective responses in clinical trials.”

Lead Turnstone TIL program TIDAL-01 is currently in a Phase 1b study evaluating the cell therapy in solid tumors where bulk TILs have shown limited to no objective responses. The study is enrolling patients with breast cancer, colorectal cancer, and uveal melanoma. The company presented preclinical data for the therapy during the annual meeting of the American Association for Cancer Research in April.

TIDAL-01 is also being evaluated in a separate Phase 1 clinical trial, an investigator-initiated study in collaboration with Moffitt Cancer Center. This trial is enrolling patients with cutaneous melanoma that has failed to respond to earlier lines of therapy.

Since its inception in 2015, Turnstone had raised $172 million from stock financings, most recently the 2021 Series D round that raised $80 million. Versant Ventures is Turnstone’s largest shareholder, owning 14.8% of the company after the IPO, followed by OrbiMed’s 12.6% stake, according to the filing.

Turnstone reported its cash position as of the end March was just $33.5 million and the IPO filing includes a warning about the company’s ability to continue as a going concern. Following the IPO, Turnstone plans to spend between $70 million and $75 million to support the ongoing Phase 1 studies of TIDAL-01. Both studies are expected to report preliminary data in mid-2024. Another $15 million to $20 million is budgeted for bringing the TIDAL-02 program through the selection of a drug candidate. It will also support plans for bringing the combination of TIDAL-01 and a viral immunotherapy through the submission of an investigational new drug application.

Image by the National Cancer Institute