Profiting from health: The self-insurance story

For decades self-funding has been the method of choice for very large companies, but now companies as small as 20 employees are looking to get out of fully-funded plans.

For decades self-funding has been the method of choice for very large companies, but now companies as small as 20 employees are looking to get out of fully-funded plans.

Moderate cost trends in the large-employer market seemingly contrast with those in the Affordable Care Act’s online marketplaces.

In an era of escalating healthcare costs and a growing preference for natural, holistic approaches to health, The Impact Brands emerges as a collective of diverse brands dedicated to supporting overall wellness through natural means.

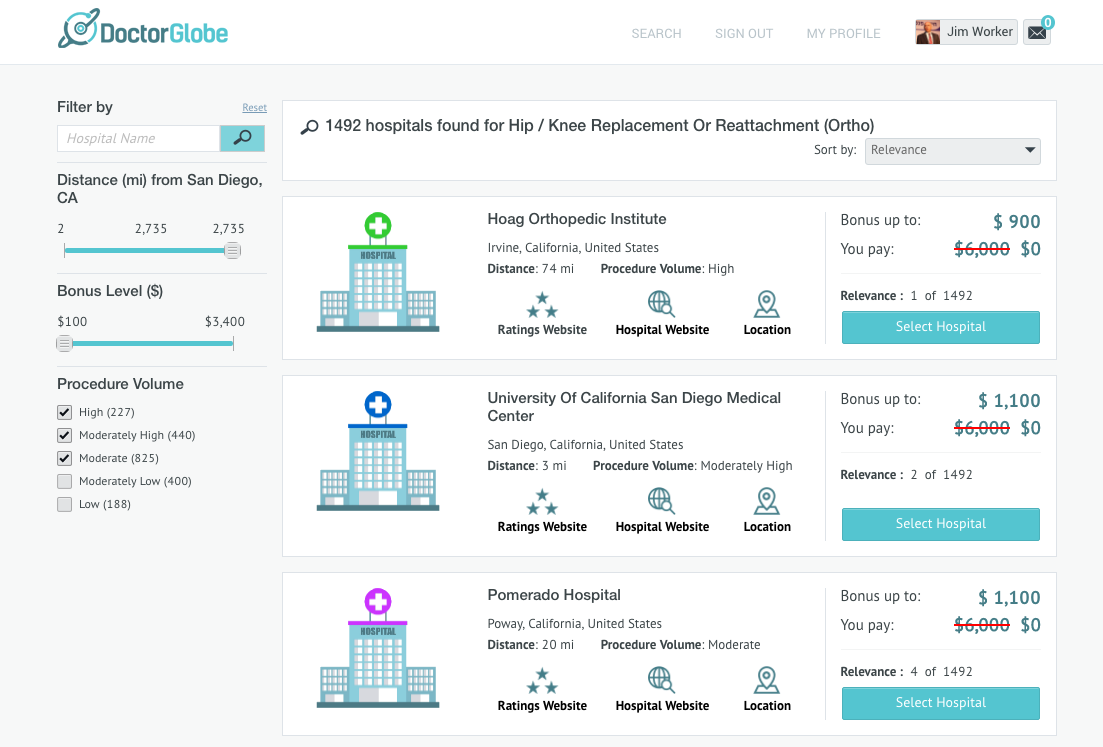

DoctorGlobe, which serves members and sponsors of self-insured employer health plans, displays patient out-of-pocket responsibility rather than the price providers bill the employer for.

The 10 most common conditions for stop-loss payments accounted for more than half of all such claims in the last three years, according to Sun Life Financial U.S.

The current fight centers on larger employers that tend to self-insure because they have the financial resources to pay their own medical claims. They often hire an insurer to negotiate with hospitals for discounted rates as part of their health plan network for employees.

Many employers face a major plan design change or revision to the pricing structure to accommodate the additional cost

This eBook, in collaboration with Care Logistics, details how hospitals and health systems can facilitate more effective decision-making by operationalizing elevated awareness.

The interest in employers cutting healthcare costs has purred the growth of companies claiming their employer wellness tools can make it easier for employers to satisfy those goals. But a new report sheds some light on the downside of employer wellness programs, particularly the invasiveness people feel in their personal lives and concerns by patient […]

As I said at the close of the first day of ENGAGE, I heard this phrase much more often than I expected to: We have to meet people where they are. I am surprised at how fast this “how do we get employees to be healthy?” conversation has shifted, even since ENGAGE 2013. The focus […]

Nearly one company in six in a new survey from a major employer group plans to offer health coverage that doesn’t meet the Affordable Care Act’s requirements for value and affordability. Many thought such low-benefit “skinny plans” would be history once the health law was fully implemented this year. Instead, 16 percent of large employers in a […]

Dr. Robert Galvin is chief executive officer of Equity Healthcare, where he works with executives of nearly 50 companies that purchase health coverage for 300,000 people. Galvin says the 2010 Affordable Care Act has made employers more engaged in health benefits while encouraging their workers to be savvier health care consumers. “I think what the […]

The TSX Venture Exchange has a strong history of helping early-stage health and life sciences companies raise patient capital for research and development.

Newly hired employees who don’t sign up for health insurance on the job could have it done for them under a health law provision that may take effect as early as next year. But the controversial provision is raising questions: Does automatic enrollment help employees help themselves, or does it force them into coverage they […]

Boeing and some of the Northwest’s largest health care providers are teaming up to provide what they say will be higher-quality, more-affordable care for some of the aerospace giant’s employees. To accomplish this, the company will work with accountable care organizations, or ACOs, an increasingly popular strategy for health-care delivery that puts more responsibility on […]

What if employers started giving workers a chunk of cash to buy health insurance on their own instead of offering them a chance to buy into the company plan? Are workers ready to manage their own health insurance like they do their 401(k)? The idea that employers might decide to drop their health plans and replace […]

Paul Keckley sees one result of all the financial and policy battles going on around the Affordable Care Act: higher costs for everyone. In his second weekly memo as a consultant, he wants Congress and state leaders to drop the partisan gamesmanship and lift the ACA out of the political fight. He lists three reasons: […]

$6.9 million. That’s the error tax “average US employer” pays for hospital errors, given 1,000 admissions in a year for all covered lives. The Leapfrog Group got that number from its new calculator. It’s designed to help employers figure out the hidden tax that comes from getting care from C, D or F hospitals. The […]