AstraZeneca’s cell therapy ambitions have led to several recent business deals. The latest one has the pharmaceutical giant partnering with Cellectis, a company that uses gene editing to overcome hurdles facing cell and gene therapies.

According to deal terms announced Wednesday, AstraZeneca is kicking off the alliance with $105 million, which breaks down to $25 million in upfront cash and an $80 million equity investment in Cellectis. At the outset, AstraZeneca’s stake in its new partner will be about 22%, but that could soon grow.

When Investment Rhymes with Canada

Canada has a proud history of achievement in the areas of science and technology, and the field of biomanufacturing and life sciences is no exception.

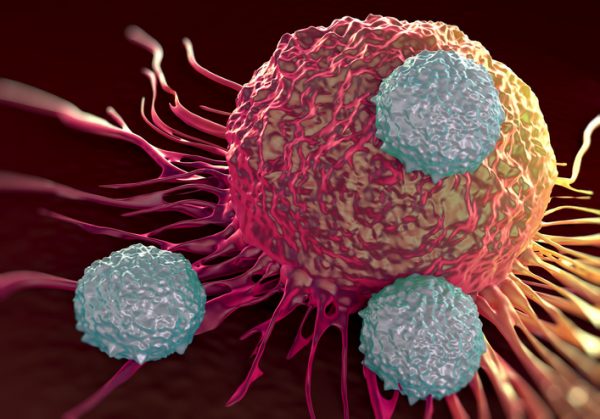

Paris-based Cellectis develops its therapies by editing cells with its proprietary gene-editing technology, called TALEN. Using this technology, the company is developing allogeneic, or off-the-shelf, cell therapies that could overcome some of the logistics and manufacturing challenges facing currently available autologous cell therapies. Cellectis also aims to use cell therapy to treat solid tumors, which have eluded cell therapies so far.

Cellectis’s internal cell therapy pipeline spans various blood cancers. The company also has allogeneic cell therapies for cancer licensed to Servier Pharmaceuticals and Allogene Therapeutics. Cellectis’s alliance with AstraZeneca covers oncology as well as immunology and rare diseases. Cellectis has reserved 25 genetic targets for AstraZeneca. None were disclosed, but up to 10 of them will be explored for development under the new partnership.

The agreement calls for AstraZeneca to fund Cellectis’s research costs. AstraZeneca has an option to exclusively license the products developed under the collaboration. Options must be exercised prior to the filing of an investigational new drug application. Cellectis is eligible for option fees as well as milestone payments ranging from $70 million to $220 million for each of the 10 therapeutic candidates. If AstraZeneca commercializes any of them, Cellectis will earn royalties from sales.

AstraZeneca will make its equity investment in Cellectis at the price of $5 per share. The deal calls for the pharma giant to invest another $140 million, also priced at $5 per Cellectis share, in early 2024. When that investment closes, AstraZeneca will own about 44% of Cellectis. The vote of confidence from AstraZeneca is winning over Cellectis investors. Shares of the company opened Wednesday at $2.71, up more than 182% from Tuesday’s closing price.

The Impact Brands: Empowering Wellness Through Natural and Holistic Solutions

In an era of escalating healthcare costs and a growing preference for natural, holistic approaches to health, The Impact Brands emerges as a collective of diverse brands dedicated to supporting overall wellness through natural means.

“The differentiated capabilities Cellectis has in gene editing and manufacturing complement our in-house expertise and investments made in the past year,” Marc Dunoyer, chief strategy officer of AstraZeneca, and CEO of Alexion, AstraZeneca Rare Disease, said in a prepared statement. “AstraZeneca continues to advance our ambition in cell therapy for oncology and autoimmune diseases as well as in genomic medicine, which has potential to be transformative for patients with rare diseases.”

The Cellectis collaboration comes nearly a year after AstraZeneca struck a $200 million deal to acquire Neogene Therapeutics, a startup developing cell therapies capable of targeting solid tumors. That deal followed the $68 million acquisition of gene-editing biotech LogicBio. The pharma giant also has a CAR T cell therapy in the clinic under an agreement with Rockville, Maryland-based Cellular Biomedicine. Earlier this year, AstraZeneca began a cell therapy partnership with London-based startup Quell Therapeutics. This alliance is focused on immunology, spanning programs in type 1 diabetes and inflammatory bowel disease.

Image: royaltystockphoto, Getty Images