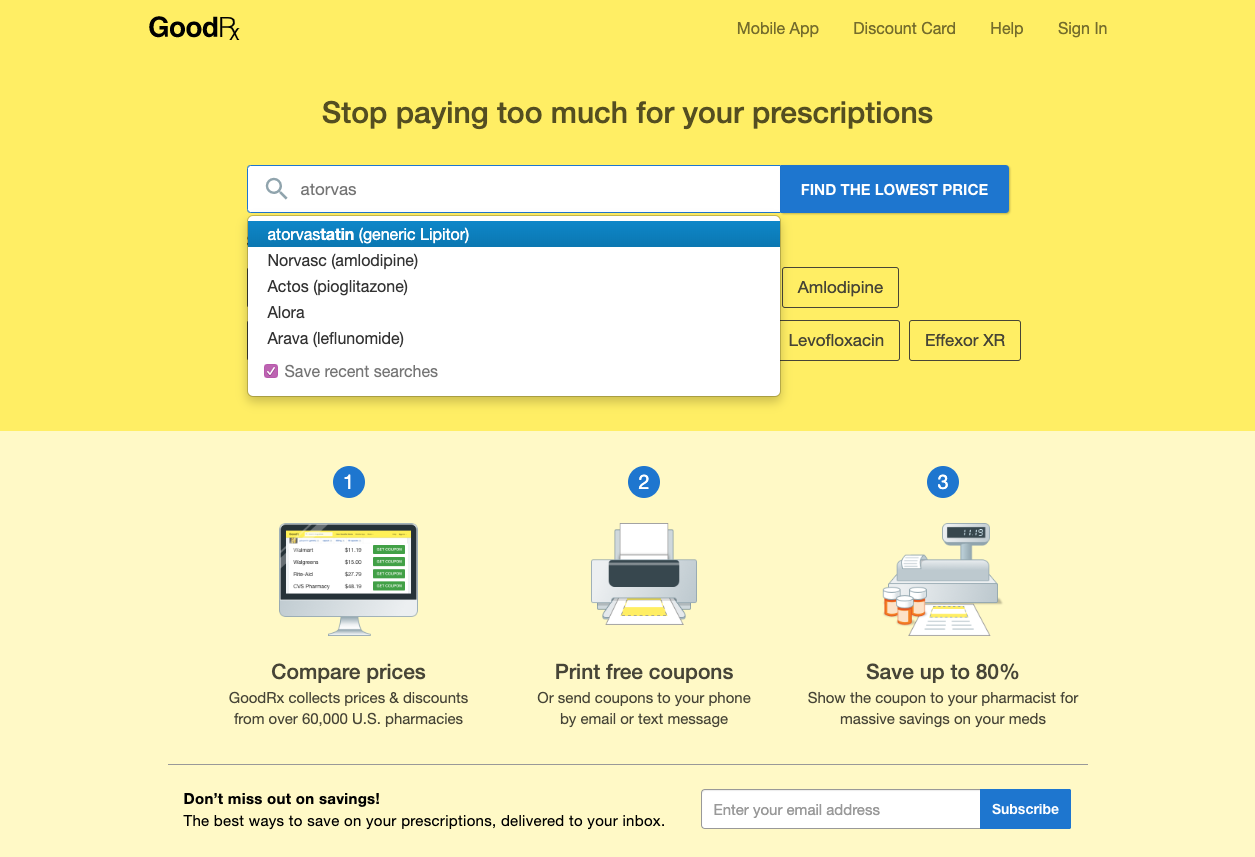

GoodRx lets users search for prescription discounts. Photo credit: GoodRx

GoodRx began trading on Nasdaq in a much-anticipated public debut. The startup, which helps users “shop” for prescription discounts, raised $1.1 billion in its IPO.

“As much as we’ve accomplished in the past decade, we recognize that there is a tremendous amount of work — and opportunity — ahead of us,” Co-Founders and Co-CEOs Trevor Bezdek and Doug Hirsch wrote in a blog post accompanying the news. “As a public company, we hope to provide even more services that help people get the healthcare they need at a price they can afford.”

The Impact Brands: Empowering Wellness Through Natural and Holistic Solutions

In an era of escalating healthcare costs and a growing preference for natural, holistic approaches to health, The Impact Brands emerges as a collective of diverse brands dedicated to supporting overall wellness through natural means.

Most of GoodRx’s business comes from a tool consumers can use to compare drug prices at different pharmacies. It negotiates with pharmacy benefit managers to offer discount coupons for cash-paying customers. The company said it has 4.9 million monthly active users, most of whom are repeat customers.

GoodRx also conducts drug pricing research, and offers subscription services for prescription discounts. More recently, it has been building out a telehealth service after acquiring HeyDoctor last year. After their visit, patients can fill their prescriptions at their local pharmacy using a GoodRx discount code or through mail order.

On Wednesday, the company sold 34.6 million shares of its stock at $33 per share, above its planned range of $24 to $28 per share. By the afternoon, it was already trading above $47. In total, the company said it will see proceeds of $725 million, which it plans to use to grow its business.

Silver Lake, a previous investor in the company, bought $100 million of its stock in a private placement. It was already GoodRx’s largest stockholder, with a 35.3% stake in the company prior to the investment.

Using Informed Awareness to Transform Care Coordination and Improve the Clinical and Patient Experience

This eBook, in collaboration with Care Logistics, details how hospitals and health systems can facilitate more effective decision-making by operationalizing elevated awareness.

So far, in the first half of 2020, GoodRx has brought in $256.7 million in revenue, up 48% from last the same period last year. As for its profit, the company reported a net income of $54.68 million, up 75%.

A slew of digital health companies have gone public this summer, though the IPO window may be closing soon with the upcoming election. Still, investors expect to see more companies make the leap this year or in 2021.